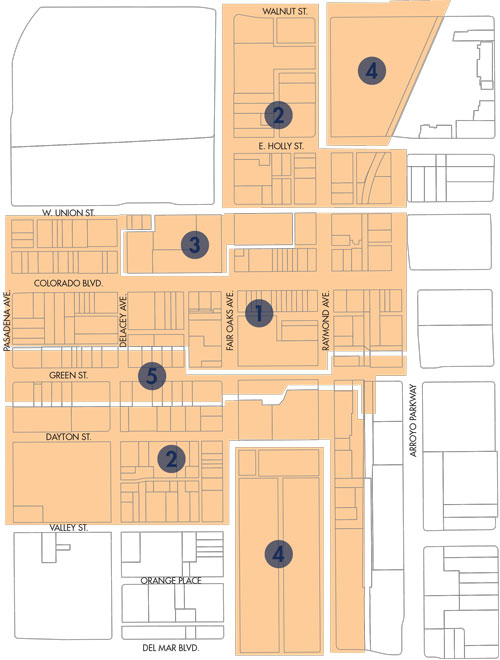

What Is a PBID - District Boundaries

PBID Overview - Renewal Campaign 2025

In 2024, OPMD initiated work on a new Strategic Plan to be incorporated into the continuation campaign for 2025. The Strategic Plan is being produced in conjunction with the consultants at Progressive Urban Management Associates (PUMA).

At the June 22, 2015, City Council Meeting, official ballots were tabulated resulting in a resounding approval (91%) for the continuation of the Old Pasadena Management District (OPMD). A final resolution was adopted to continue the Old Pasadena Management District, a Property-Based Business Improvement District (PBID), for a ten-year term ending December 31, 2025.

Since its formation in 2000, the Old Pasadena Management District has advanced the remarkable history of success that makes Old Pasadena a leader among business districts around the nation. OPMD has established standards for cleanliness and security that make residents and visitors alike feel more welcome and at ease. It aggressively promotes Old Pasadena as a destination, creates special events to bring in new visitors, and advocates for property owners, businesses, and residents.

Continuation documents (Exhibit A):

- Old Pasadena PBID Management Plan

- Old Pasadena PBID Management Plan Summary

- What You Get with Your Assessment

For more information:

What is the Old Pasadena Management District?

What Are the District Boundaries?

Frequently Asked Questions

Q. What is a PBID?

A. A Property-based Business Improvement District (PBID) is a unique funding tool which allows business district property owners to pool their financial resources by assessing themselves to pay for certain district-wide activities and improvements. There are over 100 PBIDs throughout California and upwards to 1,500 throughout the country. PBIDs have been found to be the most effective and fair method to fund business district programs.

Q. What is the primary benefit of a PBID?

A. Competition for trade dollars is increasing and changing all the time. Much more can be accomplished by working together as an organized unit than by working alone. There is the advantage of group purchasing power for funding area-wide improvements and programs.

Q. Is a PBID just another government program?

A. No. The local government agency’s role is to initially approve establishment of the PBID and collect or cause to be collected, the funds from the County Tax Collector. The funds will be used to pay for the programs and activities authorized by the approved Management Plan.

Q. Is a PBID assessment a new tax?

A. No. Taxes go into government agency general funds to be used throughout their jurisdictions as needed. PBID assessments, however, can only be levied and used within the PBID boundaries to fund programs and activities authorized by the approved Management Plan. The PBID must be re-approved after each term that the PBID expires (5 years initially and up to 10 year periods thereafter).

Q. Which properties are assessed?

A. All properties within the boundaries of the PBID will be assessed unless specifically exempted by law. Assessments will vary based on the projected proportionate special benefit to be conferred on each property.

Q. How much is each property charged?

A. An equitable formula has been developed whereby assessments are computed based on a combination of the property size and building size in proportion to the expected level of benefit to be derived from the programs, improvements and activities being funded.

Q. Can the assessment formula or programs be changed in the future?

A. Other than as specified in the District Management Plan, the assessment formula and broad programs can only be changed by a process involving notices to property owners and by holding public hearings.

Q. What is required for the PBID to be renewed?

A. PBID formation is governed by state law and city policy. All property owners receive a "petition packet" in the mail prepared by the Old Pasadena Management District Continuation Committee. Included in this packet is a Continuation brochure, a link to the Management District Plan and Engineer's Report, and a preliminary support petition to be signed and returned to the committee. If the returned petitions equal 50% plus $1.00 of the proposed total PBID assessment, the City will conduct an election of PBID property owners (required by Proposition 218, adopted 11/96). If favorable returned ballots outweigh opposing returned ballots, based on assessment dollars, the City Council can then approve the PBID renewal following a public hearing.

Q. How long will I have to pay the assessment?

A. The proposed PBID will have a 10-year life. The new assessment will first appear on your December 2015 property tax bill, and the last assessment will appear on the April 2025 bill.

What Are the District Boundaries?

District Boundaries and Zoning Map

How Am I Assessed?

Assessment Formula Table 2014-2015

|

|

Land Assessment |

Ground |

Non-Ground |

|

ZONE 1 |

$0.2742 |

$0.3235 |

$0.1616 |

|

ZONE 2 |

$0.1383 |

$0.2577 |

$0.1288 |

|

ZONE 3 |

$0.1698 |

$0.2793 |

$0.1395 |

|

ZONE 4 |

$0.1383 |

$0.2577 |

$0.1288 |

|

ZONE 5 |

$0.1992 |

$0.2722 |

$0.1360 |

* Boundaries and formulas are subject to change for the new term of the PBID, beginning 2015.

Sample Assessment Calculation:

Assume there's a two story building in Zone 5 on a 5,500 sq. ft. lot with 5,000 sq. ft. of ground floor and 4,500 sq. ft. of non-ground floor:

| 5,500 | sq. ft. | land assessment |

x |

$0.1992 |

= |

$1,095.60 |

|

5,000 |

sq. ft. |

ground floor |

x |

$0.2577 |

= |

$1,288.50 |

|

4,500 |

sq. ft. |

non-ground floor |

x |

$0.1360 |

= |

$612.00 |

|

|

|

|

|

$2,996.10 |

The total PBID assessment would be $2,996.10 per year, $249.68 per month, or $8.21 a day.